The cost of volatility: Learning from nature’s strategy for stability

Mar 21, 2024

Recently I was tasked with the question: “why are plants green?” My knowing answer (as distinguished from an answer rooted in understanding) was that plants are green because of chlorophyl. This was then challenged by, “okay…but if plants wanted to absorb a lot of light, shouldn’t plants be black?” I had no response to that.

Following a bit of research, I found that the answer was practical and resonated with me as an investor. Plants are green because it allows their internal photosynthetic processes to be more stable and their energy capture more consistent, even though that stability and consistency is achieved at the expense of maximum energy capture and efficiency.1 As I learned, if a plant was black for maximum energy capture, its internals would be subject to subtle changes in light, like those caused by shadows. Clouds would shut off the flow of energy and this on/off fluctuation would prove to be too noisy to the plant’s internals.

Additionally, if it captured the full brunt of sunlight, it could cause free radicals and damage within the plant. Thus, the plant focuses on capturing similar wavelengths in order to prevent harm to its internals, yet it also seeks to capture different types of light so that it can maintain consistency as shadows and bright sun change the intensity of light. The result of balancing between these two objectives is for the plant to absorb the darker blue and the red/orange ranges of light, which leaves the lighter blue and yellow uncaptured. The reflection of this uncaptured blue-yellow blend makes plants appear green.

A strong case for consistency

That plants focus on consistency over maximum energy capture and efficiency reminds me of how in investing it is often better to focus on consistency of return rather than trying to constantly achieve maximum return.

A focus on consistency is, in effect, a focus on managing volatility, which underpins our approach to portfolio construction and diversification. I’m going to borrow an excerpt from “The Cost of Concentration” by my colleague John Raus that highlights the benefit of consistent returns. His analysis puts some tangible numbers behind what is often called the “volatility tax”:

To illustrate, imagine a portfolio valued at $100 million that is expected to return an average of 0% over the long term with symmetrical volatility. Many would assume that the portfolio will maintain its $100 million value over time. But let’s dig a bit deeper. If the portfolio experiences a 10% loss followed by a 10% gain, the correct math would lead us to a final portfolio value of $99 million—less than our starting point and counter to our assumption of breaking even. Repeat this pattern for a very long time and the portfolio steadily declines in value as a result of volatility alone.

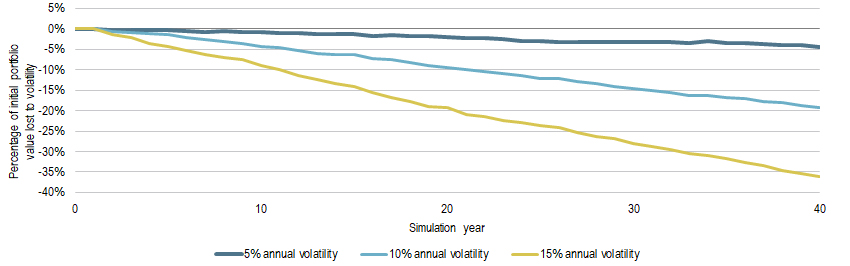

Maintaining the assumption of symmetry from above, Exhibit 1 captures the effect of volatility on portfolio growth, independent of any skew in the return distribution.

Holding the portfolio starting value and expected annual return constant, we see that increasing expected volatility leads to a faster decline in portfolio value as a result of volatility alone and absent any securities transactions. At 15% annual volatility, (roughly the annual volatility an investor might expect from a well-diversified equity portfolio) the portfolio in our illustration has lost more than 30% of its starting value by the 40th year.

Exhibit 1: Increases in portfolio volatility can lead to faster declines in portfolio value over time

Median value lost to volatility for 10,000 simulated portfolios (by volatility assumption)

Calculations by Fiduciary Trust International using data sourced from proprietary simulation as of 10/12/2020

We can estimate this volatility drag and thus the “effective compound return” of a portfolio. For a portfolio with an expected long-term average return of 10% and volatility of 15%, the effective compound return is 8.9%. This means that an investor can expect to lose 1.1% per year to price movements. While many investors understand this cost in the short run, its long run consequences can be underappreciated and frequently overlooked.

Turning down the dimmer on volatility

Solely attempting to maximize return with significant volatility can be extremely costly. If an investor can earn the same or similar expected return—but with significantly lower volatility by diversifying their investments—this would translate into a higher long-term compound return purely from limiting the variability of their portfolio.

Said differently, when the sun is shining brightly and there are lots of returns to be had, investors with a diversified portfolio may not capture the full opportunity. However, when there’s a dark shadow and returns are negative or scarce, the diversified investor can weather that challenge far more effectively than the return-maximizing investor. A diversified portfolio tends to avoid being the best or worst performer over short time periods, but over time, the diversified investor will likely end up ahead and the consistent path will help keep the investor’s internals more stable along the way.

Key Takeaways

Important Disclosure

This communication is intended solely to provide general information. The information and opinions stated may change without notice. The information and opinions do not represent a complete analysis of every material fact regarding any market, industry, sector or security. Statements of fact have been obtained from sources deemed reliable, but no representation is made as to their completeness or accuracy. The opinions expressed are not intended as individual investment, tax or estate planning advice or as a recommendation of any particular security, strategy or investment product. Please consult your personal advisor to determine whether this information may be appropriate for you. This information is provided solely for insight into our general management philosophy and process. Historical performance does not guarantee future results and results may differ over future time periods.

IRS Circular 230 Notice: Pursuant to relevant U.S. Treasury regulations, we inform you that any tax advice contained in this communication is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any transaction or matter addressed herein. You should seek advice based on your particular circumstances from your tax advisor.

Related Insights

Webinar: 2026 Investment Outlook

Profitability expands as policy uncertainty fades

Beyond AI: Policy clarity, consumer challenges and broader participation in 2026

Talk to Us Today

Let us review your current situation and show you how we can empower you to reach your financial goals.